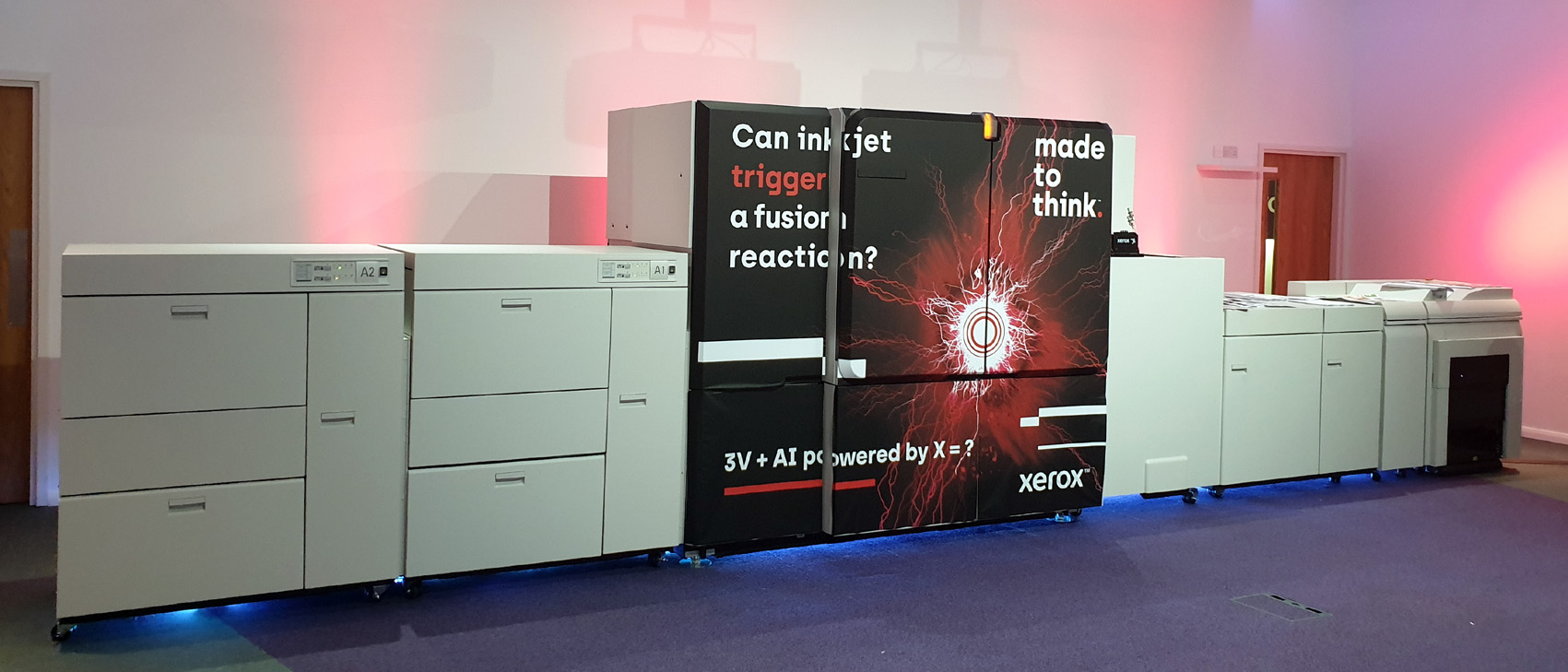

FujiXerox was founded 57 years ago, as a sales organization for Xerox in the Asia-Pacific region and increasingly as development and manufacturing operation for many Xerox products. It started out as 50-50% joint venture but with Fujifilm buying half of Xerox’s stake in FujiXerox, Xerox was left as minority owner. Today almost all toner products sold by Xerox are in fact FujiXerox products. Quizzed on that point, Xerox always stated how closely aligned and coordinated development activities between both companies are. In today’s global business the split in distribution regions between Xerox and FujiXerox became more and more of an oddity. Every vendor of a certain size strives to sell global to offset ever increasing product development costs and spread other overhead. In 2018 Fujifilm proposed to take control of Xerox by merging Xerox and FujiXerox and paying out Xerox shareholders. This did not happen and gave way to some protracted dealings between the two companies.

This came to an end now. In an agreement made public on the 5th of November 2019 Fujifilm will acquire the 25% stake Xerox still holds in FujiXerox for a sum of $2.3 billion. The sum paid is remarkably similar to the $2.5 billion which would been paid to the Xerox shareholders, would the original deal have happened. As part of the deal Fujifilm will drop the litigation filed against Xerox after the original deal was cancelled. Both companies have now the opportunity to sell into the other territories and to OEM products to/from other companies.