Why drupa still matters

Drupa 2024 is only days away. I will attend for seven days. This will be my eighth drupa, after starting in 1990 still as a printing technology student. Attending a drupa has always been a highlight, first in my job in R&D and especially as an analyst and industry expert for digital print technologies.

There has been some talk about the relevance of trade shows lately. Especially, after the pandemic-induced break and the rise of virtual fairs or presentations. Also, budgets are getting tighter and the audience for print shows, printing companies, is dwindling.

Still, I find that trade shows are important, and even if participants should always question the value of attending, I believe the industry needs a flagship tradeshow like drupa. Here are a couple of reasons why drupa still matters:

- Print is technology driven. Granted, the business model needs to come first but using technology is still required and does make a difference in capabilities and costs.

- Online events are not an adequate substitute. Too little chance to ask questions (especially the ones not asked in front of a big audience), limited views on what is presented, and little detail in general. Moreover, virtual presentations are not always that efficient considering the info you get and the time you spend. I covered the virtual drupa in 2021 (here, here, here and here) and while it was entertaining in parts, the content was not that helpful.

- Print is tactile; hence I want to hold the output of a press/embellishment/finishing device in my hand. Also, a close look at the build of a piece of equipment is telling.

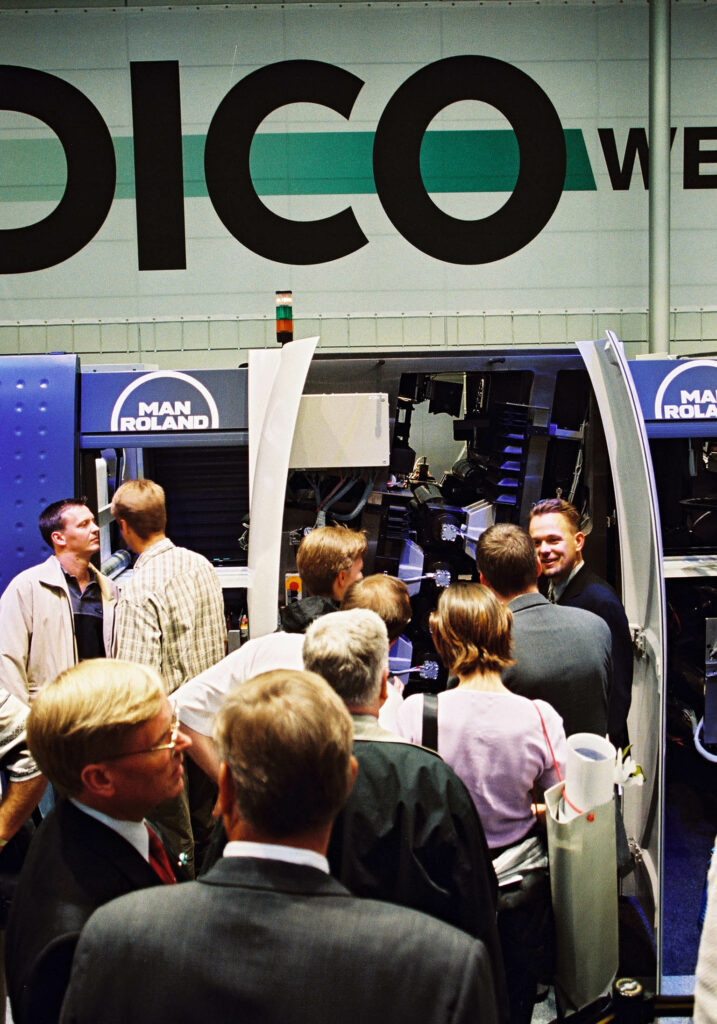

- Trade shows are networking places. The best information still stems from personal conversations, based on the trust created between persons meeting physically.

- Open houses are great but they are not as efficient as trade shows. In seven days, I will probably talk to 50 different companies. At an open house (including travel), I spend two days to speak to one company.

- Traditionally drupa is the one place where suppliers not only share their technology roadmap, they also show prototypes and technology demos. Suppliers get feedback on technologies, customers the insurance that suppliers are investing in new, competitive technologies. Everybody gets an idea of future possibilities and how to build ecosystems around it.

- The serendipity of trade shows should not be underestimated. We tend to be well informed about the technology areas directly affecting us and vendors will make sure that we get those news. However, print is versatile, full of niches, and changing constantly, so it makes a lot of sense to get inspired and what might be a market to enter in the future or how to use new tech to become more efficient.

The big question is, do exhibitors achieve an ROI? Usually, equipment is not sold anymore directly on the trade show floor. Smaller companies certainly do benefit most, as a trade show is their best platform to showcase their products and services. Bigger companies still benefit from a close customer contact by presenting new tech and their complete portfolio, personal contacts to customers and prospects, and by showing their solutions as part of a partner workflow (or find these partners). If a company is strictly cost driven and doesn’t have new technologies to present, it should not exhibit as the expenses are substantial. At the same customers and potentials should deduct that the company is not investing in new technologies, which will be a concern in the future

For me, there are many reasons why drupa still matters. I believe it is also good for the industry to have that one focal point where everything and everybody converges.