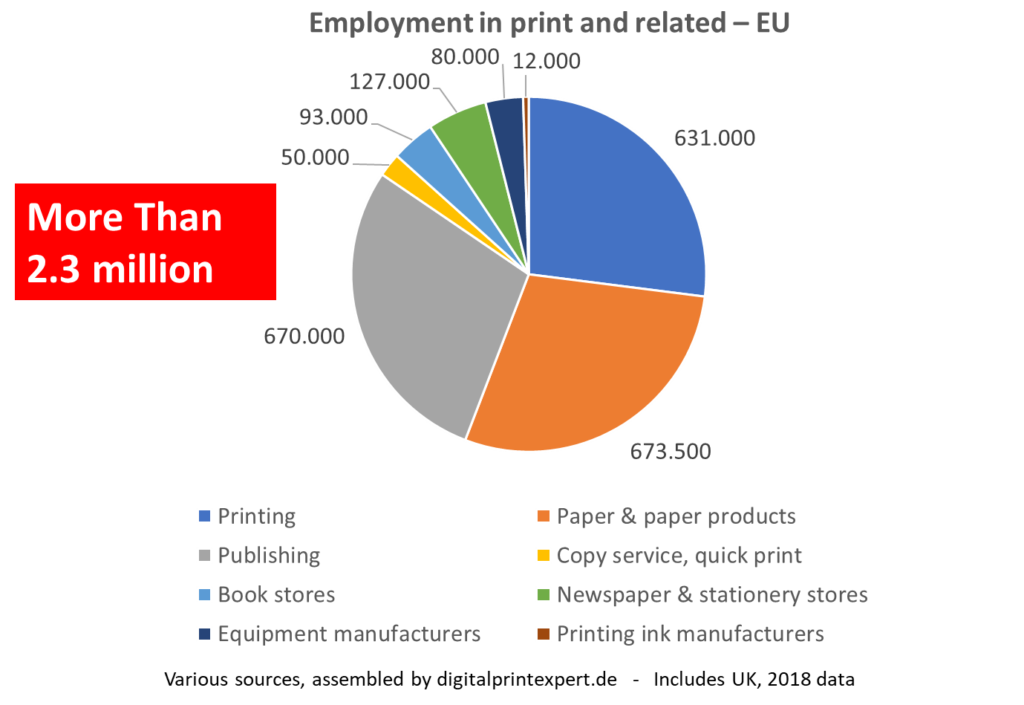

How big is the European printing industry

A question often posed to me is: how big is the European printing industry. The answer depends very much on the markets you want to include. The obvious ones in the graphic arts industry include Graphic Arts print (which subsumes in the statistics commercial print and also more specialised printers like book, catalogue, forms or magazine printers). The only application specific type of printing company split out in the statistics is newspaper print. Prepress and postpress companies contribute to the graphic arts industry revenue, although strictly speaking they do not print. Important print producers that should be added, while not included in graphic arts statistics, are label and packaging printers – although commercial printers produce smaller volumes of label and packaging print as well as part of their services. Often overlooked in the statistics are photocopy services and in-house printing sites, the latter including data centre print.

There are some markets more difficult to size. Direct mail is produced as part of commercial print but also in advertising services – a portion that cannot be easily identified. Décor print (like wallpaper, furnishing, ceramics or textile) is missing as well, as the value of the print produced is hidden in the goods production. Also some small or niche packaging segments lack a good data basis.

In the view I recommend, those 10 segments contribute to the European printing industry revenue:

- Printing of newspapers

- Graphic Arts Print

- Pre-press and pre-media services

- Binding and related services

- Folding carton

- Flex Pack printing

- Corrugated printing

- Label printing

- Photocopy services

- In-house printing

Graphic Arts print (including publication and specialty print) contributes the biggest single chunk to the European printing revenue. Label and packaging printers combined add about the same amount (although some additional packaging output stems from commercial print, as mentioned above). The high substrate costs in label and packaging print drive up the revenues, while by surface area printed, commercial print would a much higher. Other segments are noticeably smaller but still add to the pie.